There’s a lot of talk about Australia’s hot property market. Prices in Perth are up 20 per cent in the last year alone. The property market is defying interest rates that have shot upwards at record pace.

But one major market is missing out, and it is the city that is, by some measures, Australia’s largest. Melbourne property prices are falling even as the rest of the country rises.

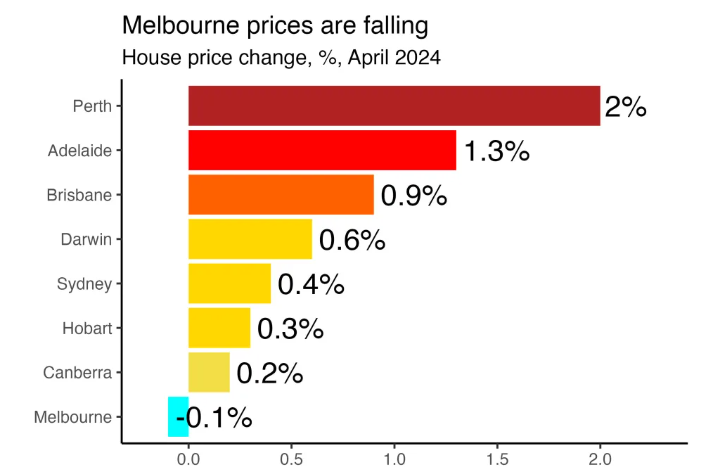

As the next chart shows, the southernmost capital on the mainland is an outlier.

CoreLogic says property prices fell in Melbourne in April, despite astonishing growth elsewhere in the country.

And it’s not just April, Melbourne prices haven’t risen in the last 3 months, even as all other capital city markets have risen, some very quickly.

What’s going on? There seems to be a lot of property for sale in Melbourne. The rate of listings is very high, up 35 per cent compared to a year ago. People are selling up. But why?

There’s no shortage of new arrivals. Students on temporary visas are pouring in, and arrivals on permanent visas are also. While arrivals are a little lower than they were in the past, departures are lower too meaning the population of visitors (students, temporary workers, etc) is very high.

And this is where the interesting wrinkle comes in. Rents in Melbourne are high and rising, even as property prices stall and fall, as the next chart shows.

The rate of rental inflation in Melbourne is astonishingly high, just like the rest of the country.

Rents rose 6.8 per cent in Melbourne over the year to the March quarter, far faster than inflation.

The demand for somewhere to live is there. It’s just not manifesting as property purchases. Or at least not enough to absorb the volume of property that is up for sale.

Auction clearance rates in Melbourne are languishing at 59 per cent in the most recent weekend, well below the level that usually keeps prices rising.

Don’t get me wrong, you can still pay a lot of money for a fairly small house in a desirable suburb in Melbourne, as the next picture shows. I can only imagine how much this house – less than 5 metres wide – would cost in a hot market.

Rental vacancies in Melbourne are almost impossible to find. Just 0.8 per cent of rental properties are vacant, well below pre-pandemic levels.

So we have a bit of a paradox with a tight rental market and a weak market for home sales.

Perhaps the people coming into Victoria simply aren’t buyers. Students and temporary workers aren’t usually interested in property purchases. But usually, that would mean a great time for landlords to buy up property, lease it out and make a fortune.

There is an additional factor that could explain why landlords are a bit tentative and why some owners might be selling up: taxes. Victoria has a new tax on properties that are vacant, which is hitting some holiday homes. It is also levying land tax on more properties than before, in an attempt to pay down COVID debt.

Anecdotal reports suggest some landlords are selling up rather than absorbing the tax. That could explain the rush of properties hitting the market and depressing prices.

So the big question is whether this leaves Melbourne under-priced compared to the rest of the country. Median dwelling values in Melbourne ($783,000) are now cheaper than those in Brisbane ($828,000) and Canberra ($848,000), and not so far ahead of Adelaide ($748,000).

The Victorian economy is a bit weaker than the rest of the country as the state heals from the effect of COVID and lockdowns, and Melbourne isn’t ranked as the world’s most liveable city any more, but the longer-term economic potential of Melbourne is still very strong.

Will it have a comeback? Only time will tell.