Pundits are split on whether the market will continue to build on the momentum gained through the start of the year, or whether it will revert back to the more traditionally quiet winter period.

The Reserve Bank of Australia (RBA) held the cash rate at 4.35 per cent on Tuesday despite the March quarter consumer price index (CPI), an indication of inflation, rising by 1 per cent.

If the RBA moves to cut interest rats in the later part of this year, that could put additional pressure on the market. However, most experts now believe any cuts to the official cash rate are more likely to come in 2025, which could temper the intensity of what has been a very hot property market this year.

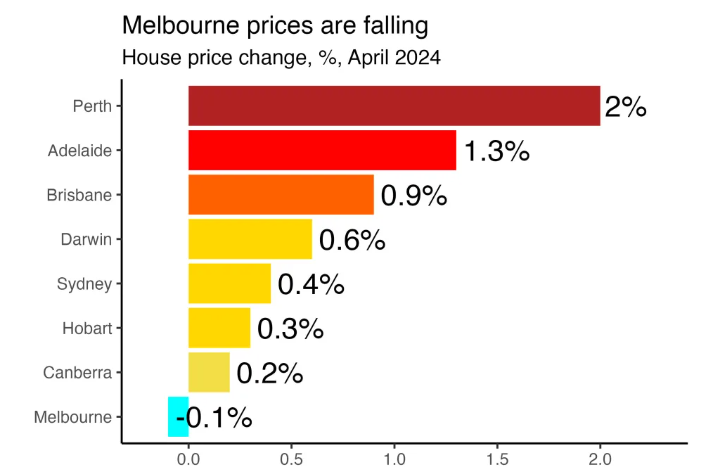

Domain’s latest House Price Report revealed that the combined capitals’ median house price hit a record $1.113 million. Houses in a number of cities, including Sydney, Brisbane, Adelaide and Perth, also recorded record prices, as did units in Brisbane, Adelaide and Perth units.

AMP chief economist Shane Oliver says he is expecting rate cuts to begin next year, which could dampen the upcoming winter market.

“Lower interest rates have been discussed since earlier this year, and you can argue that they helped buoy the market over the last few months, but now there’s a risk of it delaying until next January,” Oliver says.

“If that’s the case, buyers will become less patient if the rate [cut] is delayed and hold off on making property decisions during winter until that cash rate is cut. That could have a negative impact on the market, given we’ve already seen some cooling in recent weeks.”

Domain’s monthly clearance results showed Sydney hovering just under the 70 per cent mark earlier this year, but in recent weeks, the city’s weekly auction rates have been sitting at around 60 per cent, Oliver says.