A renewed appetite for risk from US investors drove all Wall Street’s key indices higher on Friday and the positive sentiment has flowed through to the ASX this morning.

However, the local focus is due to switch to inflation data this week which may determine whether the odds of a rate hike here shorten.

Follow the day’s financial news and insights from our specialist business reporters on our live blog.

- ASX 200: +0.9% to 7,991 points (live values below)

- Australian dollar: +0.2% at 65.62 US cents

- S&P 500 (Friday): +1.1% to 5,459 points

- Nasdaq (Friday): +1.0% to 19,024 points

- FTSE (Friday): +1.2% to 8,286 points

- EuroStoxx (Friday): +0.9% to 502 points

- Spot gold: +0.9% to $US2,386/ounce

- Brent crude: -1.5% at $US81.13/barrel

- Iron ore (Friday): +2.6% to $US102.40/tonne

- Bitcoin: +0.8% to $US68,020

Regional airline REX enters trading halt

The ASX listed regional airline REX has requested a trading halt ahead of making a material announcement dealing with a media report over the weekend.

It is understood the article relates to a piece published in The Australian’s Margin Call column suggesting the airline has called in turnaround team from consultants Deloitte.

Rex has also been suffering a degree of turbulence in the boardroom with former executive chair Lim Kim Hai departing to be replaced by former Howard government minister and deputy chair, John Sharp.

The trading halt will remain in place until Wednesday, or until Rex releases its next statement.

ASX up 0.9% on opening

The ASX 200 has bounced out of the blocks and is up 0.9% at 10:20 AEST following on from Wall Street’s strong lead.

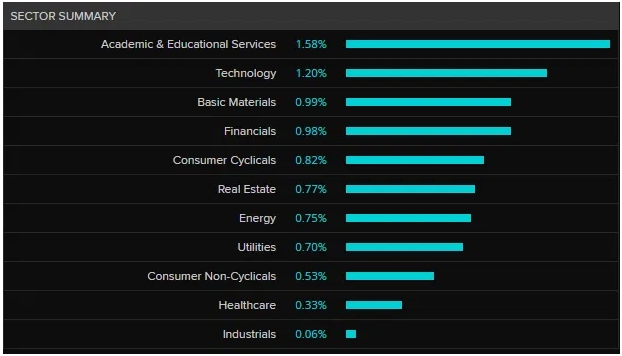

All key sectors have made gains with solid moves in basic materials/miners and financials, while every stock in the blue-chip Top 20 are also in positive territory.

A lift in iron ore prices on Friday has supported Rio Tinto (+1.5%), Fortescue (+0.9%) and BHP (+0.6%).

The banks are all up, led by NAB (+1.3%), while insurer QBE (+1.3%) and investment bank Macquarie (+1.2%) are also being bid up.

The electronic payments platform Zip is the best performing stock on the ASX 200, up 4% on a successful capital raising this morning.

NZ-based Fletcher Building is down 3.8% after issuing an earnings warning on supply chain problems in its cement business.

The health insurer NIB has also lost ground (-2.5%) after announcing its veteran CEO Mark Fitzgibbon would be retiring in September.

A big week for central banks

It’s a big week for central bankers in the US, Japan and UK sitting down to chew the monetary fat.

The RBA has another week and will be fretting over Wednesday’s inflation data before deciding whether a hike is needed.

According to ANZ’s morning note, Japan is the only bank likely to change its settings raising its key benchmark rate by 15 basis points on Wednesday.

The market has a 68% likelihood of hike priced in.

In the UK, the betting is more like 50:50, but the Bank of England is likely to sit tight (Thursday) waiting for a moderation in wages and services CPI before being able to cut.

But the big one is the US Federal Reserve’s decision on Wednesday.

The ANZ is part of the broad consensus that rates will be kept unchanged, although noting a “dovish shift in stance is likely” in the official communication.