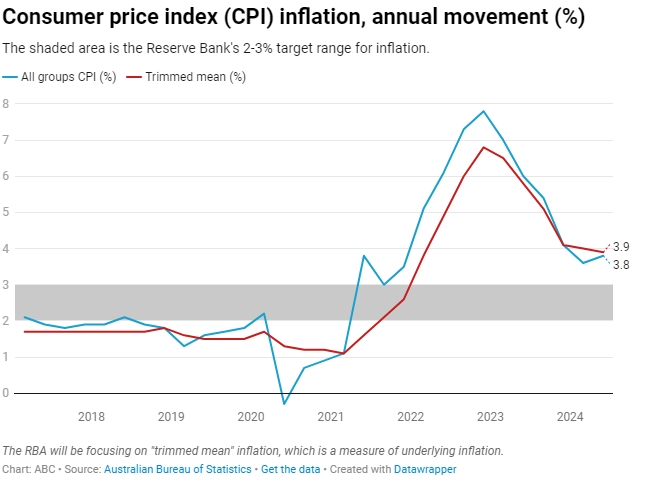

Australia’s annual rate of inflation has risen to 3.8 per cent, up from 3.6 per cent at the start of the year.

According to the Australian Bureau of Statistics (ABS), prices rose by 1 per cent in the June quarter, which followed the 1 per cent increase in prices in the March quarter.

That has pushed the pace of headline inflation up slightly, which is the first increase in annual consumer price index (CPI) inflation since the December 2022 quarter.

Economists had anticipated the increase in headline prices so it hasn’t taken officials by surprise.

But significantly, the “trimmed mean” measure of inflation, which is an important measure of underlying or “core” inflation the Reserve Bank focuses on, fell slightly in the June quarter.

It declined from an annual rate of 4 per cent to 3.9 per cent.

The RBA wants that trimmed mean measure of inflation to fall back down into the 2 to 3 per cent range, and that specific measure of inflation has been declining continuously for the last six quarters.

“Today’s CPI release confirms that inflation is as sticky as expected but, importantly, is no higher than the RBA had forecast it to be,” said BDO Economics partner Anders Magnusson.

“This is good news as the RBA tries to keep a lid on inflation without losing the gains made by workers through a strong labour market,” he said.

“Today’s release has not changed our forecast that the next movement by the RBA will be a rate cut in early 2025. We don’t believe that the RBA will raise the cash rate next week, but the ongoing cost-of-living struggles for many Australians will likely continue until early next year,” he said.

The RBA Board will meet on Monday and Tuesday next week to discuss what to do with interest rates.

The cash rate target is currently 4.35 per cent.

A number of market economists have welcomed the inflation numbers, saying a rate rise next week was probably unlikely now.

Financial markets analyst Evan Lucas said the value of Australia’s dollar dropped immediately once the numbers were released — from roughly US65.32c to US64.84c — which suggested currency traders weren’t expecting a rate hike next week either.

Treasurer Jim Chalmers also welcomed the inflation numbers, noting they were in line with RBA forecasts.

He also pointed out that headline inflation had taken longer to start rising quickly in Australia than in comparable countries, and it was clearly falling down again with a similar lag.

“We’ve seen around the world that inflation can zig and zag on the way down – and, because Australia’s inflation peaked lower and later than in many countries, we’re seeing that trend here now,” he said.

“We know that demand is weak in our economy because people are under pressure, which is why our economic plan is all about fighting inflation without crunching the economy.

“Our cost-of-living relief is easing pressure on Australians, and ABS analysis today shows it’s directly taking pressure off inflation,” Dr Chalmers said.

Annual food inflation eases for the sixth quarter in a row

Data show the annual food inflation eased to 3.3 per cent in the June quarter, down from 3.8 per cent in March and the peak of 9.2 per cent in December 2022.

The ABS said price rises were lower across most food categories, except for fruit and vegetables, which were 3.7 per cent higher compared to 12 months ago.

“Unfavourable growing conditions drove higher prices for grapes, strawberries, blueberries, tomatoes and capsicums,” the ABS noted.

Meat and seafood prices, as a category, have now fallen by 0.4 per cent over the last 12 months.

Compared to 12 months ago, lamb prices are down 10.9 per cent and beef is down 3.6 per cent, although pork is up 4.7 per cent.

Rental price growth remains high due to tight rental markets

However, the ABS data show that, despite the small decline in underlying inflation in the June quarter, a number of key prices in the economy still increased too quickly for too many households.

Rental prices have risen by 7.3 per cent over the last 12 months, down from 7.8 per cent in the March quarter.

ABS officials said that rental price growth continued to reflect low vacancy rates and a tight rental market, and they would have been higher without government support.