As iron ore prices drop, Australians could see increased taxes and cuts to services as demand for our mining resources takes a hit. The resource boom and commodity trading has seen Australia escape the worst of multiple global economic downturns, with iron ore selling $136 billion lat year alone.

In July, Rio Tinto celebrated the shipment of four billion tonnes of iron ore from the Pilbara in Western Australia to China. But as Beijing’s economy worsens, top steelmaking firm Baowu finally admitted it will receive no significant stimulus package from Xi Jinping’s Chinese Communist Party.

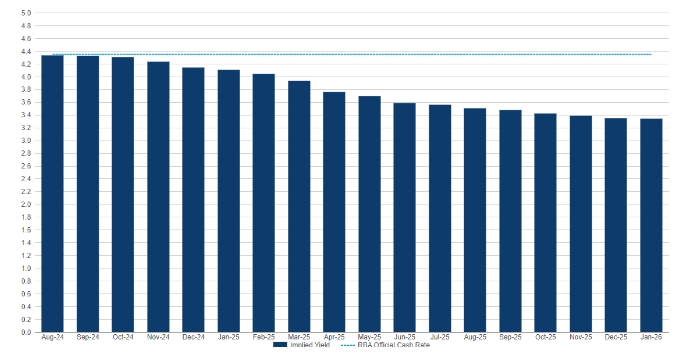

Treasurer Jim Chalmers has warned that the federal Albanese government may need to make some tough decisions as a result, while the RBA is also watching closely. But it’s not just China’s economy. Experts say the whole steel industry is shifting, with Australia now facing growing international competition from Brazil, the Middle East and Africa who are offering greener iron ore alternatives with environmental benefits.

It’s all part of the global economic transformation from fossil fuel-based economies like ours, to zero carbon-leading ones. Steelmakers around the world are seeking new ways to process iron ore, but new technology like electric-arc furnaces need either ultra-high-quality iron ore or recycled metals.